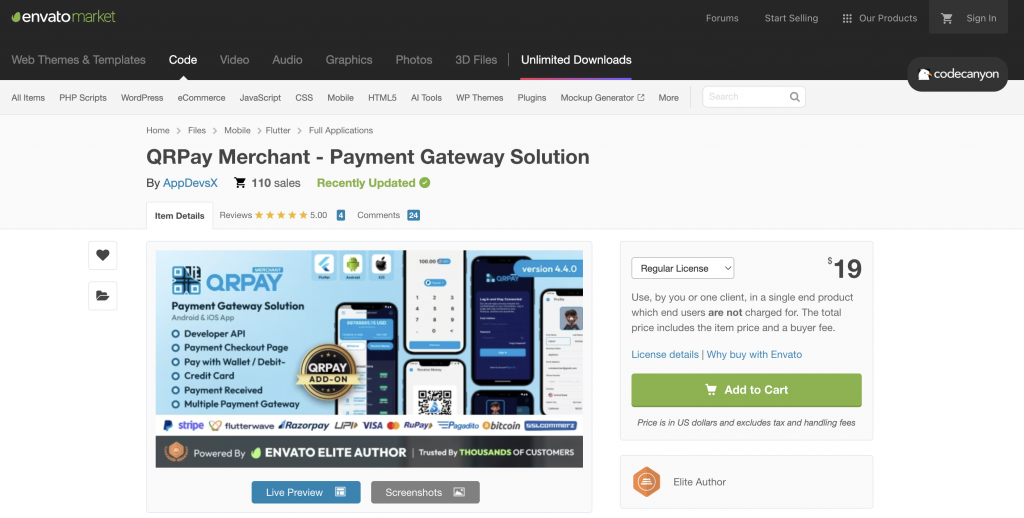

QRPay Merchant is an innovative payment gateway solution designed for seamless transactions using QR codes. It ensures a secure payment checkout page, making fund transfers from customers to merchants quick and reliable. With its robust features, QRPay Merchant stands out as a top choice for businesses looking to enhance their payment processes.

Table of Contents

ToggleQRPay Merchant – Payment Gateway Solution

In today’s fast-paced digital world, the need for efficient and secure payment solutions is paramount. QRPay Merchant offers a cutting-edge payment gateway solution that leverages QR codes to facilitate swift and safe transactions. This solution caters to businesses of all sizes, ensuring a smooth transfer of funds from customers to merchants.

Transfer of Funds from the Customer to Merchant

QRPay Merchant simplifies the payment process by allowing customers to make payments through QR codes. Here’s how it works:

- QR Code Generation: Merchants generate a unique QR code for each transaction.

- Customer Scans QR Code: Using their smartphone, customers scan the QR code displayed at the point of sale.

- Payment Authentication: The payment gateway authenticates the transaction details.

- Secure Payment Checkout Page: Customers are redirected to a secure payment checkout page to complete the transaction.

- Funds Transfer: Once authenticated, the funds are transferred from the customer’s account to the merchant’s account in real-time.

Main Features of QRPay Merchant

1. QR Code Payment Integration

QRPay Merchant integrates seamlessly with various platforms, allowing businesses to generate and use QR codes for payments easily. This feature not only speeds up the checkout process but also reduces the chances of errors compared to manual entry of payment details.

2. Secure Payment Checkout Page

Security is a top priority with QRPay Merchant. The secure payment checkout page ensures that all transactions are encrypted and protected against fraud, providing peace of mind to both merchants and customers.

3. Real-time Transaction Updates

Merchants can monitor transactions in real-time, enabling them to track payments as they occur. This feature is particularly beneficial for managing cash flow and ensuring timely payment processing.

4. User-Friendly Interface

The platform boasts a user-friendly interface that simplifies the setup and management of the payment gateway. Even those with minimal technical knowledge can navigate the system with ease.

5. Multi-Platform Compatibility

QRPay Merchant is compatible with multiple platforms, including web and mobile applications. This versatility ensures that businesses can offer convenient payment options to their customers, regardless of the device they use.

Pros and Cons

Pros

- Easy Integration: QRPay Merchant integrates effortlessly with existing systems, minimizing the need for extensive technical support.

- Enhanced Security: With a secure payment checkout page and robust encryption, transactions are safeguarded against unauthorized access.

- Real-Time Monitoring: The ability to track transactions in real-time helps businesses manage their finances more effectively.

- User-Friendly: The intuitive interface makes it easy for merchants to manage their payment gateway without specialized knowledge.

Cons

- Dependent on Internet Connectivity: Like many digital payment solutions, QRPay Merchant requires a stable internet connection to function optimally.

- Initial Setup: While the interface is user-friendly, initial setup may require some time and technical understanding, especially for businesses new to digital payment systems.

Pricing

QRPay Merchant offers competitive pricing tailored to the needs of different businesses. Pricing plans typically vary based on the volume of transactions and the specific features required by the merchant. It is advisable to contact the QRPay Merchant sales team for a detailed quote that aligns with your business needs.

Final Thoughts

QRPay Merchant stands out as a reliable and efficient payment gateway solution that leverages the power of QR codes to streamline transactions. Its secure payment checkout page, real-time monitoring, and ease of use make it an attractive option for businesses looking to enhance their payment processes. While dependent on internet connectivity, the benefits far outweigh this minor drawback, making QRPay Merchant a valuable addition to any business’s payment infrastructure.